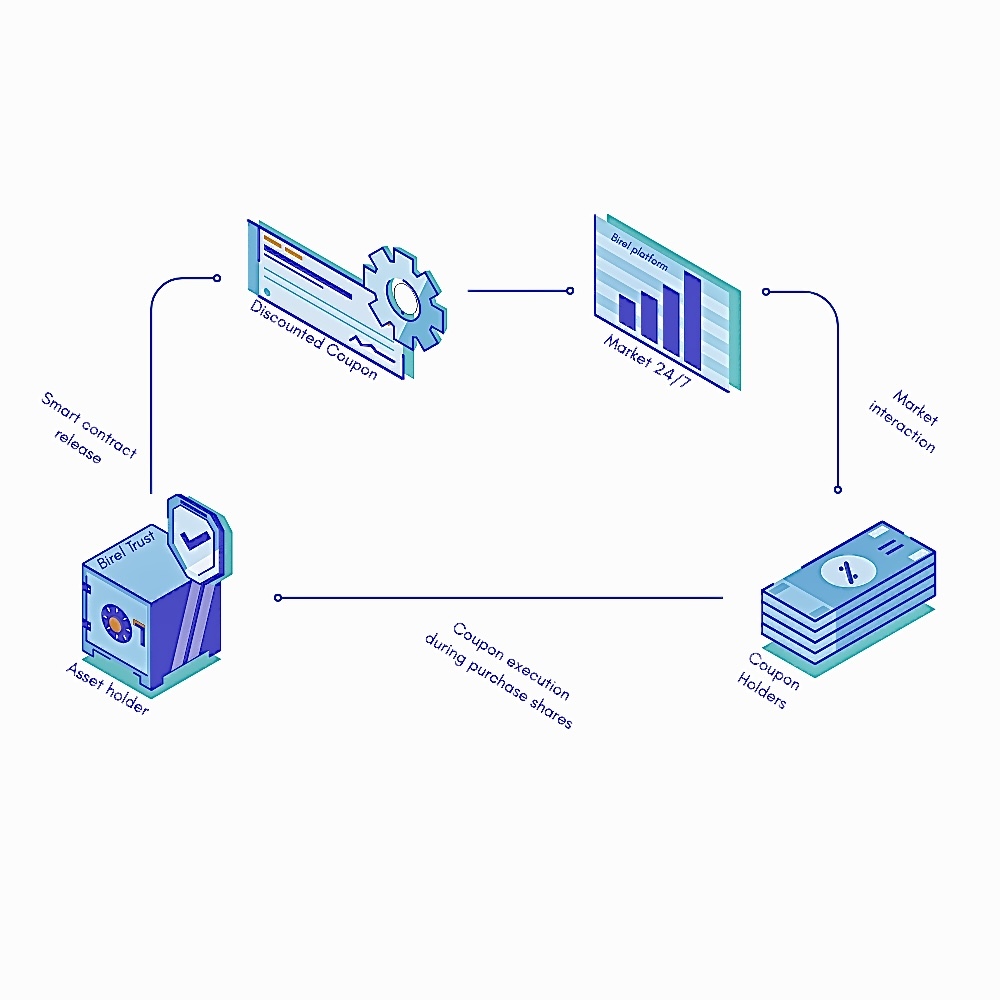

A digital coupon is an instrument that allows holders to participate in the equity of high-demand private companies with strong potential before they become public, while avoiding conventional bureaucratic hurdles.

Democratizing access to equity in sought-after private companies through Discounted Coupon.

Birel allows being a part of high-quality private companies without high threshold:

Digital coupons grant their holders the right to purchase a share in a certain asset at a discount (-80%, for instance) when the principal asset within the trust holding becomes publicly traded or undergoes a liquidity event. Our tool enables the broad audience to access the value of highly sought-after private companies even before they go public.

: Coupons are not a security or derivative, as they do not grant a fixed ownership right to an asset or a set execution price. Instead, a coupon represents a discount at the time of purchase.

: Coupons are not a security or derivative, as they do not grant a fixed ownership right to an asset or a set execution price. Instead, a coupon represents a discount at the time of purchase.

Sustainable and liquid

Liquidity 24/7. Possibility to buy and sell coupons within the platform.

Unlock future value of high-demand private equity assets.

Full coverage. The instruments issued by Birel are fully aligned with equity holding structures.

Transparency and Stability. Reserved assets are held in fully structured holding entities, protected from bankruptcy.

Undergoing quarterly audits

Fully programmable instrument

Contemporary financial market tool, smoothly yet confidently transforming the perception of private assets into a more flexible structure, enriched with liquidity.

Features Birel

Discounted Coupon VS Tokenize Asset

- Access for a wide audienceHolding a Discount Coupon does not require the holder to be accredited.

- Only for accredited investorsTokenized private equity is focused on accredited investors due to regulatory requirements.

- Low entry thresholdThe starting investment is $100, making the tool accessible to a wide audience.

- High entry thresholdUsually, the minimum investment amount start from $ 10 K+, which is a threshold for investors.

- Low regulatory burdenCoupons are not classified as securities, simplifying compliance.

- High bureaucratic burdenTokenized assets are regulated like securities, requiring licenses and reporting.

- LiquidDiscounted Coupon can be exchanged 24/7 on the Birel open market.

- Liquidity with barriersOTC exchange or securities can be exchanged on special platforms with an AMS license, with a high entrance threshold.

The bridge connected a broad audience with beloved private companies.

02

Each Coupon represents discount on the asset* share owned by trust, which Coupon holders can apply when the principal asset holds by trust becomes public (liquid).

03

Liquidity and Freedom. Digital coupons are liquid and can be exchanged within the Birel platform 24/7.

01

Transparent holding structure that reflects value. Managed by board directors, with regular audits. Strict KYC / AML policy.

timing

Private companies today are staying private longer, which limits early investment opportunities. For example, Tesla was valued at 1.7 billion at the time of its IPO, whereas now a similar high-demand company might be valued at 100 billion or more at IPO. Birel expands opportunities by allowing retail investors to become part of private companies alongside large funds.

The user can transfer shares if he has a number of coupons equivalent to the amount of shares with a nominal value of 10К US dollars or more.

The coupon is issued for 10 years after which Birel engages an independent appraiser and broker to redeem its trust and provide liquidity to coupon holders.

At the moment you cannot withdraw your tokens from the platform, which is primarily due to KYC/AML regulations. However, this is not necessary as Birel will provide custodian services and liquidity for holders.

Each coupon, when initially issued, represents a specific discount on a share of a particular asset for which the Birel trust holds the rights. 1 DC = Discount for 1 Share in future.

We are working hard to avoid this and will give a final answer before the first discounted coupon is listed.

Let's talk!

If you have any questions or would like to know more, please feel free to contact us.

For business/partnership/investment inquiries

richard@abstra.agency

For business/partnership/investment inquiries

richard@abstra.agency

By clicking on the button, you consent to the processing of your personal data.

Subscribe to our social networks to stay up to date with all the news.